ACoS, ROAS, CPO… Which KPI is the right one to measure performance marketing in the context of Amazon Advertising in a meaningful and effective way?

Is it only about hard sales figures that result directly from the PPC campaigns? What about the impressions? And what role do the BSR (bestseller rank), CVR (conversion rate) and CTR (click-through rate) play?

If you look at an Amazon advertising report without much experience or practical knowledge – and in the worst case compare it directly with Google Ads or other advertising formats – it can easily happen that you as an advertiser draw the wrong conclusions and adjust your own bidding and budget strategy in a rather suboptimal way.

The most important key figures in Amazon Advertising

Before we delve deeper into bidding strategies, budget allocation and the interpretation of “recommendations” by Amazon employees, I would first like to briefly define and explain the most important metrics and key figures in the Amazon context – because experience has shown that these are often confused, misinterpreted or not properly understood.

ACoS

When it comes to click-based or click-priced advertising on Amazon, the abbreviation ACoS quickly comes to mind. It stands for Advertising Cost of Sales, i.e. the share of advertising costs in the sales generated. Or to put it simply: How much have I invested and what have I earned in return?

Example:

I invest 100 euros in Amazon Advertising and generate 2,000 euros in sales. The ACoS – i.e. the share of advertising costs in sales – is 5% in this case.

ROAS

The abbreviation ROAS stands for Return on Advertising Spend and is somewhat more familiar to many than ACoS. ROAS basically means the same as ACoS – only from the opposite perspective.

Example – analogous to ACoS: I invest 100 euros in PPC marketing and generate 2,000 euros in sales. The ROAS here is 20 (or 2,000 %), i.e. my advertising budget has increased twentyfold in direct sales.

Impressions

The impressions show you how often your ad was actually shown to users. For example, if someone enters the search term “salad bowl” on Amazon and you have placed Sponsored Product Ads for this keyword, the impressions will tell you how often your ad was shown.

CTR

The CTR (click-through rate) indicates how often users actually clicked on your ad after it was displayed.

Example: Your ad was displayed 2,000 times (impressions) for the keyword “salad bowl”, and there were 50 clicks – your CTR is 2.5 %.

CVR

CVR stands for conversion rate, i.e. how often a click on your ad actually results in an order.

Let’s stick with the example above: 2,000 impressions → 50 clicks → 5 sales. In this case, the conversion rate (based on the clicks) is 10%.

CPC

A short and simple explanation: CPC (cost per click) describes the costs incurred per click on an ad. As Amazon – like Google – works with a bidding process, the actual CPC usually differs from the maximum bid set.

Example:

Advertiser 1 bids EUR 0.50 per click on the keyword “salad bowl”, Advertiser 2 bids EUR 0.60.

Advertiser 2 wins the auction – its ad is displayed.

If the ad is now clicked, Advertiser 2 only pays EUR 0.51 CPC – i.e. one cent more than the next lowest bid (Advertiser 1). Although 0.60 euros was bid, the full amount is not charged, but only the click price corresponding to the bidding procedure. This is the current procedure. However, the first rumors are already circulating that there are considerations to no longer only charge the next highest amount (e.g. 0.51 euros), but to charge the full maximum bid in the event of an auction win. This would presumably fill Amazon’s advertising coffers considerably – and at the same time lead to a fundamental change in the bidding strategy of sellers, vendors and agencies. Until now, you could bid whatever you wanted – you were only ever charged the next highest click price plus 1 cent. If this procedure were to change, advertisers would have to realign their strategies accordingly.

Amazon Advertising: Tips & Tricks

Now that we have clarified some key figures, let’s delve a little deeper into the matter – because there are some peculiarities in Amazon Performance Marketing that are often misunderstood or not even recognized. It is important to note that all of the following advertising tips are to be understood as best practices. This means that they do not represent official Amazon guidelines, but are based on our agency’s experience from thousands of campaigns and their evaluations that we have carried out for our clients.

Amazon Advertising Tip 1: Win BuyBox faster

Let’s assume three sellers offer the same product on Amazon at a very similar price – and all send the goods to an Amazon logistics center to benefit from Prime advantages and FBA. Whether and who ultimately wins the BuyBox depends, among other things, on certain key performance indicators in the seller account (see Seller Central). In fact, an active advertising campaign on the same ASIN can lead to winning the BuyBox faster – or in the first place. In this respect, it makes sense to at least run Sponsored Product Ads with automatic targeting on a permanent basis.

Amazon Advertising Tip 2: PPC can influence vendor orders

Since thousands of brands and manufacturers are already represented on the Amazon Marketplace, not every single vendor order (purchase order) is triggered manually, but is often determined algorithmically and executed automatically. A key lever for this is the traffic on the product – not necessarily the “hard” sales or a good conversion rate (CVR), but how many users have viewed a product.

Targeted PPC campaigns can therefore lead to orders being triggered more frequently – or in the first place. This is particularly important for vendors, as they cannot oblige Amazon to trigger orders. However, advertising campaigns increase the visibility and attractiveness of a product – and therefore also the likelihood that an order will be placed.

Amazon Advertising Tip 3: PPC has an (indirect) influence on the ranking

This is often misunderstood – so let me make it very clear once again: the mere fact that I place advertising does not directly influence the ranking. But the effect that this advertising achieves – i.e. more traffic and more sales for a product – does have an influence on the organic ranking and therefore on the general visibility of my products.

Remember: Amazon is a product search engine. The findability of your products is decisive for whether and how much you sell. With PPC campaigns, you can therefore not only directly ensure better sales figures, but also indirectly ensure better visibility, which in turn leads to more sales.

Amazon Advertising Tip 4: Pay attention to retail readiness

Before you start investing budget in Amazon Ads, you should definitely “clean up ” first – in other words: optimize product data in terms of relevance and target group. High-quality product images, optimized titles, bullet points, backend keywords and a meaningful product description form the absolute basis.

You should also make sure that you primarily advertise products with good ratings (4 stars or more) – otherwise you will burn through your advertising budget without achieving the desired effect.

Amazon Advertising Tip 5: Ensure comparability

If you want to evaluate the success of your advertising campaigns on Amazon, you need to make sure that the general conditions are as comparable as possible. For example, if a month performs significantly worse or better, this may be due to the weather or other temporary events. It therefore makes more sense to compare the same month of the previous year rather than July with August.

Other factors should also remain as constant as possible in the comparison period. This is because a price change or an update to the product data has a major impact on the impressions, CTR and CVR of your campaigns. Campaign structure, bids and the specific products advertised are just some of the many factors that can distort comparisons.

A clear recommendation at this point: run your campaigns for as long as possible (ideally a full calendar year) with as few changes as possible – so you can compare them better with the previous or following year. The more data you have, the better you can compare and optimize.

Amazon Advertising Tip 6: A low ACoS can cost a lot of profit

ACoS = advertising costs / turnover

Now we come to a point that is often misunderstood. A very low ACoS is often seen as particularly positive – after all, you spend little (or almost nothing) on advertising in relation to your turnover. Although this is basically true, it is a fallacy. An example shows why:

- Campaign A runs with an ACoS of 15 %, campaign B with 20 %.

Most people would now rate campaign A as “better”. But let’s take a closer look: - Campaign A costs 500 euros per month and generates a turnover of 3,333.33 euros.

- Campaign B costs 1,000 euros per month, but generates sales of 5,000 euros.

This alone makes it clear that a higher ACoS does not have to be worse. The decisive factor is also how high the contribution margin and the margin of the advertised products are:

- The products advertised in campaign A have a sales price of 50 euros and a contribution margin of 30 euros – i.e. a margin of 40%.

With sales of 3,333.33 euros, this corresponds to a profit of 1,333.33 euros.

After deducting the advertising costs, a profit of 833.33 euros remains. - The products advertised in campaign B have a sales price of 80 euros and a contribution margin of 40 euros – i.e. a margin of 50%.

With sales of 5,000 euros, this corresponds to a profit of 2,500 euros.

After deducting the advertising costs, a profit of 1,500 euros remains.

Conclusion: A higher ACoS can even be significantly more profitable when total sales and contribution margins are taken into account. Campaigns should therefore not be assessed on the basis of ACoS alone, but should always be considered in the context of margin, turnover and objectives.

Amazon Advertising Tip 7: Calculate ACoS correctly for vendors

The important thing to note about ACoS is that the value always refers to gross sales, i.e. the final customer price. This is correct for sellers who sell their products directly on the Amazon Marketplace in their own name. From a vendor’s point of view, however, it looks very different – because the actual ACoS is actually much higher. An example makes this clear:

- Retailer A is a Seller and sells his products directly on Amazon in his own name.

He spends 100 euros on advertising and generates sales of 2,000 euros.

→ The ACoS is 5%. - Retailer B is a vendor and does not sell its products directly to end customers, but to Amazon.

It also spends 100 euros on advertising and also generates a turnover of 2,000 euros (end customer price).

→ However, the ACoS is 10% because Amazon purchases its products with a margin of 50%.

This means: Retailer B has sold products worth 1,000 euros to Amazon – this is the actual basis for calculating its ACoS. This is because he does not profit directly from end customer sales.

Vendors must therefore always calculate the ACoS based on their actual sales values to Amazon.

This can quickly lead to disillusionment, because supposedly good ACoS values suddenly look completely different – and the profitability of a campaign must be reassessed.

Amazon Advertising Tip 8: Always take a holistic view of all sales

We have already established that ACoS can be very deceptive. In fact, ACoS is generally not a reliable indicator of overall profitability because – as explained earlier – traffic and sales have a direct impact on organic reach.

If you reduce the advertising budget, this often also leads to a decline in organic sales. The problem with this is that this effect often occurs with a time delay – a short-term reduction in the advertising budget initially has a positive effect, but if organic keyword rankings fall in the medium term, this later has a negative impact on overall sales.

It is therefore much better to consider all sales holistically – i.e. to evaluate organic traffic (ranking) and inorganic traffic (advertising) together. In this context, we also speak of CPO – cost per order. The CPO indicates how high the total costs per product sold are.

One example:

- In month A, 5,000 euros are invested in advertising, which leads to 300 direct sales worth 30,000 euros.

→ ACoS: 16.66 %

However, a total of 600 products were sold, i.e. 300 additional sales from organic traffic.

→ Total sales in month A: 60,000 euros

→ CPO: 5,000 euros / 600 sales = 8.33 euros - In month B, the advertising budget is reduced to €2,000, resulting in 150 direct sales worth €15,000.

→ ACoS: 13.33%

However, only 220 products were sold in total, i.e. only 70 additional organic sales.

→ Total sales in month B: €22,000

→ CPO: €2,000 / 220 sales = €9.09

Conclusion: Reducing the advertising budget or bids at keyword level can lead to a lower ACoS, but often has a negative impact on organic sales – which ultimately reduces the overall success of the campaign.

Amazon Advertising Tip 9: Critically evaluate Amazon recommendations

Vendors in particular often tend to adopt Amazon’s recommendations across the board and implement them without question. Just recently, one of our customers received an “optimization sheet” with over 300 campaigns and thousands of keywords advertised daily – including the following recommendations:

- For keywords with an ACoS below 15 %, the bids are to be increased by 50 % across the board.

- For keywords with an ACoS of over 15%, bids are to be reduced by 40% across the board.

Such general rules without consideration of the underlying strategy are not very useful per se. What was particularly annoying in this case was the inadequate database on which these recommendations were based: Some of the blanket “optimization tips” referred to just 1 or 2 clicks per keyword – any logic is completely missing here.

This is because every PPC campaign first requires sufficient data before a valid evaluation is even possible. Bid adjustments should therefore always be strategic, targeted and based on meaningful metrics – not on the basis of blanket automation or hasty recommendations from Amazon.

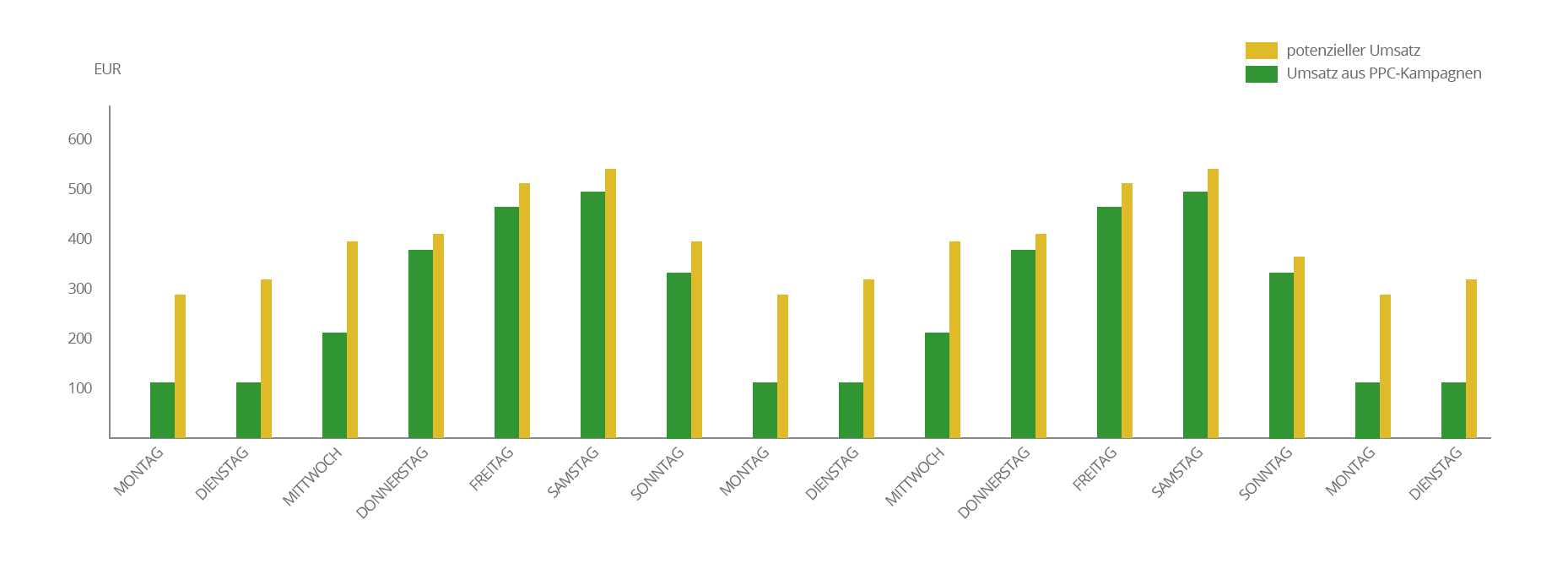

Amazon Advertising Tip 10: Distribute budgets correctly

Typical for many brands and manufacturers is misguided budget planning and a lack of flexibility in this area. Fixed advertising budgets are often set for the coming year without taking actual profitability into account. We see time and again that the budget is already used up by the middle of the week and the campaigns continue to run with lower bids as a result. The annoying thing is that hardly any sales are generated in the remaining 3-4 days – even if this would have been highly profitable. The problem: the budgets were set without reference to economic targets.

Amazon is a fast-moving and dynamic market whose developments – despite extensive experience and expertise – are difficult to predict precisely. Fixed budget limits may look good in internal controlling, but they have little to do with the goal of maximizing sales or profits on Amazon.

Instead of relying on rigid budget limits, companies should find more flexible solutions. One possible approach: investments in Amazon Advertising could increase dynamically as long as a certain CPO is not exceeded. In this way, the overall profitability of the advertising measures is maintained, while at the same time sales potential and profits are not cut off by rigid budget limits.

Conclusion: ACoS is not everything – companies must learn to think holistically

Unfortunately, the easiest way is not always the best – a good example of this is the ACoS. A quickly visible key figure in the Amazon Advertising construct, but one that can just as quickly lead to false conclusions about the overall performance of PPC campaigns.

No question: ACoS is a good indicator for gaining an initial impression of the development of advertising measures. However, it is just one of many key figures. If you look at ACoS in isolation, a particularly low value can even be economically disadvantageous.

Our urgent recommendation: move away from a pure focus on ACoS and towards a holistic view of advertising measures. It is also clear that this is much more difficult for vendors to implement, as it is often not possible to track exactly how high the total order volume with Amazon reference was in a certain period – let alone how it will develop.

Nevertheless, advertising should always be viewed in its entire context, even if measurability is sometimes challenging. And the same still applies to Amazon in particular:

If you don’t advertise, you die.